Medical Groups, as they add employed physicians (EP’s), take on a large financial obligation. Aside from salary and benefits, they also assume the expense of medical malpractice insurance coverage. Paying for medical malpractice insurance is often seen as a necessary evil in the recruitment of new doctors. Also, when the doctor leaves, the group will pay for the tail coverage of the employed physician or EP.

Why the medical groups buy medical malpractice for EP’s:

*The group confirms there is coverage since they are paying for it directly.

*The group’s medical malpractice includes two coverage components. The first is if the EP is sued, he/she is covered personally, which is not the medical group’s risk. The other part of the coverage is the entity (the medical group itself), which covers the medical group if they are named in a suit with the EP or if the medical group is named for another third-party’s exposure on a medical malpractice insurance claim.

*You may save money on the group medical malpractice insurance since there is a group rate, which includes pricing for a claim for EP’s with claims and without. It is cheaper for the EP’s with claims, than if they purchased coverage on their own; but it is often more expensive for the EP’s with no claims, than if they bought their coverage on their own. The group’s malpractice policy uses the good experience EP’s to offset the cost of the EP’s with claims.

*When the EP quits, the medical group has to pay for tail for the departing physician since this may be a requirement of the employment contract, or if not, the malpractice insurer may cancel the group or raise their rates if the group routinely does not buy tail.

This has been the SOP for all medical groups, but at HCP National we have a better cost alternative for medical group medical malpractice. The main risk for the group is the entity exposure. So we recommend the group buy the entity policy on a stand-alone policy, and does not buy Group Medical Malpractice Insurance for the EP’s risk:

*Entity stand-alone coverage is very inexpensive. It is subject to underwriting, but it is about 5 to 10 percent of the annual premium that the group was paying for all its group malpractice coverage. It also allows each EP to have any insurer. There is no requirement that the majority or all of the EP’s have the same insurer as the group policy.*the group pays the entity coverage directly so they are able to confirm that coverage is in force.

*When an EP leaves, there is no tail premium for the Entity policy, as long as the Entity policy is maintained. Tail does not apply to the Entity Policy until the day the group cancels the coverage, hopefully due to the sale of the medical group. At that time they buy tail coverage.

*You take your EP’s with the best records and get quotes from the lowest cost insurer in the standard market for MD coverage only—no entity. Also, request rates for first through fifth year or fully matured rates. When you hire an EP, your offer includes reimbursement for malpractice based on those least expensive standard rates. The EP will buy their own coverage, from a list of approved insurers; you will want to work with your broker on this list. You then base the reimbursement on the rates of that lowest cost insurer. If the EP cannot qualify for the lowest priced insurer, you reduce the EP’s salary or bonus to cover the added reimbursement. This is done up front, prior to employment and agreed to in the offer for employment. Every year you get updated rates from the lowest cost malpractice insurer to update your reimbursement. Each doctor can have his/her own insurer and policy.

*When the EP leaves, they take their policy with them.

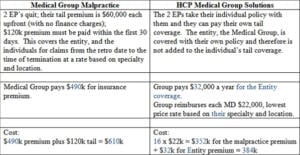

Case Study: A primary care medical group with 16 MD’s in a group, 3 partners and the remaining EP’s paying $490k a year; all MD’s have fully matured claims-made rates.

The savings yield in this year is $226k, and the year when there is no tail, you still save $106k.

HCP National is a nationwide insurance broker providing medical malpractice insurance.